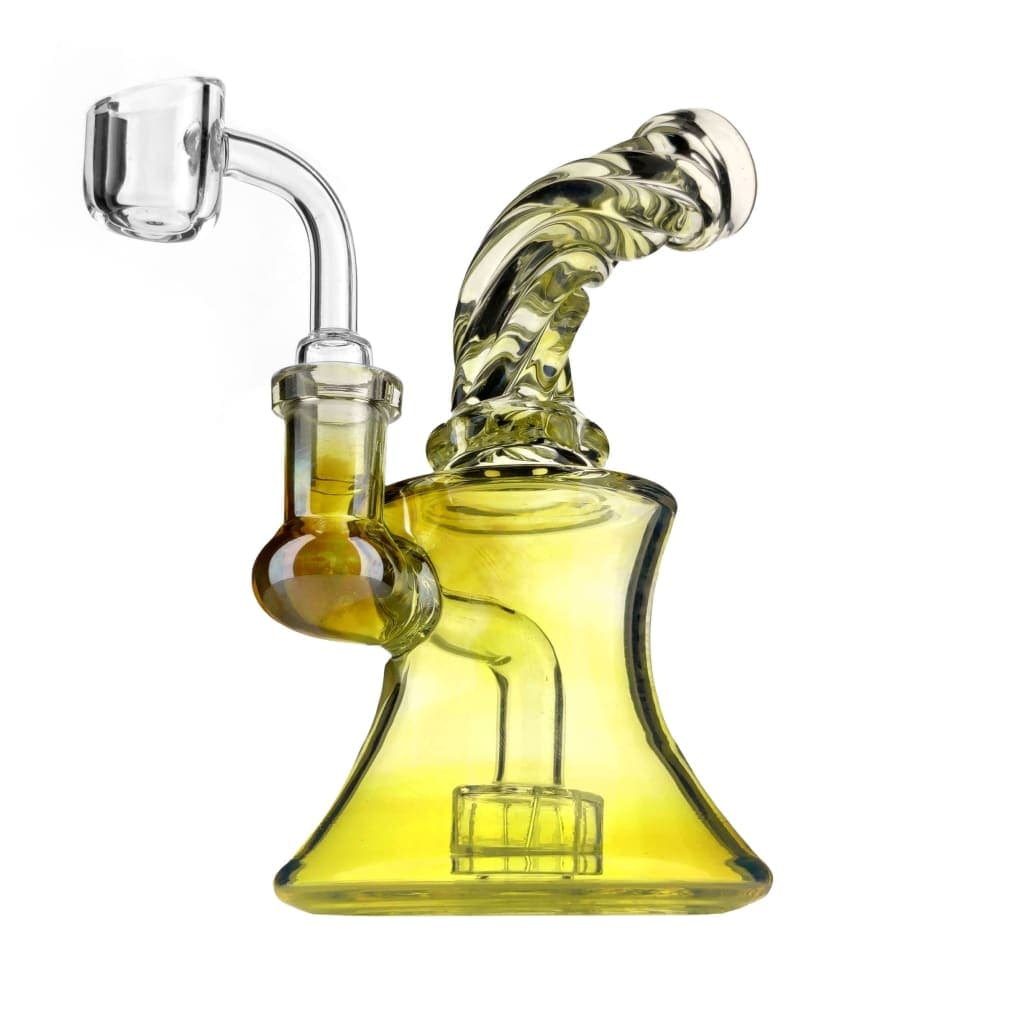

Banking & Cannabis | Sell Weed, Make Money, Now What?

California first legalized medical marijuana in 1996 and the first medical dispensary opened not long after. Since then, there has always been a dilemma in the industry…

“How do we handle the cash?”

Despite 29 states, and the District of Columbia, now having some form of legalized marijuana, the federal government still classifies cannabis as a Schedule I controlled substance and restricts FDIC insured financial institutions from handling the cash. With the cannabis industry growing into a strong $7.2 billion-dollar industry in 2016 showing $4.7 billion in medical marijuana sales and another $2.6 billion in sales from the recreational sector, lack of financial services creates major challenges for legal cannabis businesses.

In 2014, the Department of Justice and FinCEN released a set of guidelines in an attempt to address some these challenges. Although this establishes a base-line standard, it also clearly states that it will not necessarily keep a financial institution from being prosecuted. This, along with the increased monitoring that is required of the financial institution to protect themselves, and the scrutiny that is received in return still has most banks shying away from the cannabis industry, in spite of its growing success. In fact, Bloomberg reported in October, there are only 220 banks of 7700 in the US that will do business in the legal cannabis world.

Problems this Creates for Businesses

Although most consumers are frustrated when they realize they can’t use their debit card or a credit card to make their legal cannabis purchases, what happens behind the scenes is where the real problem lies. During an interview with , Taylor West, National Cannabis Industry Association associate director said, “You’re paying your staff in cash, your utility bills, your mortgage, your taxes. These businesses are operating at a very fast pace, and not being able to handle transactions electronically is just incredibly difficult.”

Besides just being difficult, it is expensive.

Increased costs for accounting – can you imagine having to track each and every cash transaction you and your business make? Cannabis businesses do. All of these transactions must be maintained by someone, which means more hours for their accountants.

Increased costs for banking – if a business actually finds a credit union or small bank that is willing to handle their cash, the marijuana business may be subject to substantial fees, as the increased account monitoring creates more expense for the bank. Some businesses have seen fees between $400 and $1000 a month just to obtain a checking account.

Increased costs for security – some dispensaries see thousands of dollars in cash each day. So where does all of this cash go at the end of the day if they can’t put into a bank account? Large amounts of cash in poorly secured buildings is a temptation too great for many criminals creating a rather dangerous situation for anyone at the location, so security systems, video surveillance, armed guards and armored trucks for transportation are simply a necessity in these cash businesses.

Yet, despite the federal government still prohibiting cannabis cash from being in the banking industry, the IRS will fine businesses for not having a bank account. According to an article from the Denver Post, the Internal Review Service tacks on a 10% fine for any payments that aren’t handled electronically, and since marijuana based businesses aren’t allowed to bank, they have to pay in cash.

Fines for cash payments aren’t the only headache when it comes to paying taxes in the industry either – marijuana businesses don’t get the same deductions as other businesses. Anyone who starts a new business takes a risk, and the tax code for small businesses was created specifically to help businesses by allowing proprietors to deduct certain business expenses. However, these deductions are not available to “federally illegal pot businesses,” and without those deductions, it can hinder the financial success of these small startups. Yet, despite significantly higher regulation, stringent monitoring, complex rules, and costly fees the cannabis industry is still flourishing and laws are still changing.

The Future of Banking in Cannabis

With the unprecedented, successful voter turnout in 2016, marijuana was legalized or expanded in eight states. Adding these states to the legal marijuana industry, experts predict the market to increase to a $21 billion-dollar industry in just four years, without factoring in any new states who may also vote to end prohibition. By 2021, weed is expected to surpass the radio industry, the toy industry, and even employ more people than US manufacturing industry. Still, the current administration has yet to even formally take a position on what they plan to do with this lucrative opportunity.

If repealing prohibition in eight states is predicted to triple the cannabis market in just four years, what would full legalization across all 50 states look like? Studies have shown that factoring in the illegal market, cannabis has the potential to become a $100 billion industry with the end of federal prohibition. Not to mention the growth it could create in other ancillary industries like agriculture and manufacturing. If cannabis were descheduled, allowing the banking industry to start handling the money, making cannabis a legitimate business in the eyes of the federal government, the US might have a completely different financial outlook. Yet, while the Department of Justice seeks out this year to crackdown on crime and illegal immigration, Jeff Sessions, US Attorney General, is still vehemently against legalizing marijuana.

Leaving cannabis exiled from the banking industry only creates more problems in an already complex environment, but until Sessions, and the rest of this administration see the potential, the banking industry waits… drooling like one of Pavlov’s dogs at the thought of adding a $21 billion-dollar untapped resource to their portfolios. In the meantime, Sessions’ backwards approach to the industry is leaving all of the good people who DO smoke marijuana, with dangerous working conditions, difficulties running their businesses, and little to none of the tax benefits other businesses are allowed. With more than half of the United States allowing legal marijuana, Sessions needs to get current with his constituents, and lift the restrictions so these businesses can have the same protections as any other.